Hello Readers👋👋

Welcome to the 10th edition of The ComPress 3.0, the newsletter brewing a captivating concoction of finance and business each week.

As promised, here is your brew of gripping and compelling content from the world of commerce and finance :D

UNLOCKING VALUE: UNVEILING THE JOURNEY OF TATA TECH’S IPO

BY: HARLEEN KAUR NANDA & ABHIJEET KOTHARI

What is an IPO?

IPO stands for Initial Public Offering. It is a process through which a private company becomes a public company by offering its shares to the public for the first time. In an IPO, a company issues new shares of its stock and sells them to the public. This allows the company to raise capital from a wide range of investors.

The process typically involves several steps:

· Hiring Underwriters: The company usually hires investment banks to act as underwriters. These underwriters help the company determine the IPO price, create a prospectus, and handle the logistics of the offering.

· Due Diligence: The company undergoes a thorough examination of its financial and business operations to ensure transparency and compliance with regulatory requirements.

· Filing with Regulatory Bodies: The company files registration statements with the relevant securities regulatory bodies, such as the Securities and Exchange Commission (SEC) in the United States.

· Roadshow: Company executives and underwriters conduct presentations and meetings with potential investors to generate interest in the IPO.

· Setting the IPO Price: Based on investor demand, the underwriters and the company set the IPO price, which represents the valuation of the company.

· Going Public: The company's shares are listed on a stock exchange, and they become available for trading by the general public.

IPOs provide an opportunity for companies to raise capital for expansion, debt reduction, or other corporate purposes. Additionally, going public allows early investors and company insiders to sell their shares on the open market. However, it also subjects the company to increased regulatory scrutiny and public reporting requirements. Investors, on the other hand, have the opportunity to buy shares in a company that was previously private. The success of an IPO is often measured by how well the stock performs in the aftermarket, i.e., after it starts trading on the stock exchange.

About Tata Technologies

Tata Technologies, incorporated in 1994, is a subsidiary of Tata Motors. It is a leading global engineering services company, one of the top performers in its industry.

It offers a varied range of product development and digital solutions, streamlining the operations. The company’s principal focus is on the automotive, aerospace, and industrial heavy machinery industries, having a significant involvement in manufacturing-focused engineering, R&D, and more.

Here are important things you should know about Tata Technologies IPO. Let’s dive into the details-

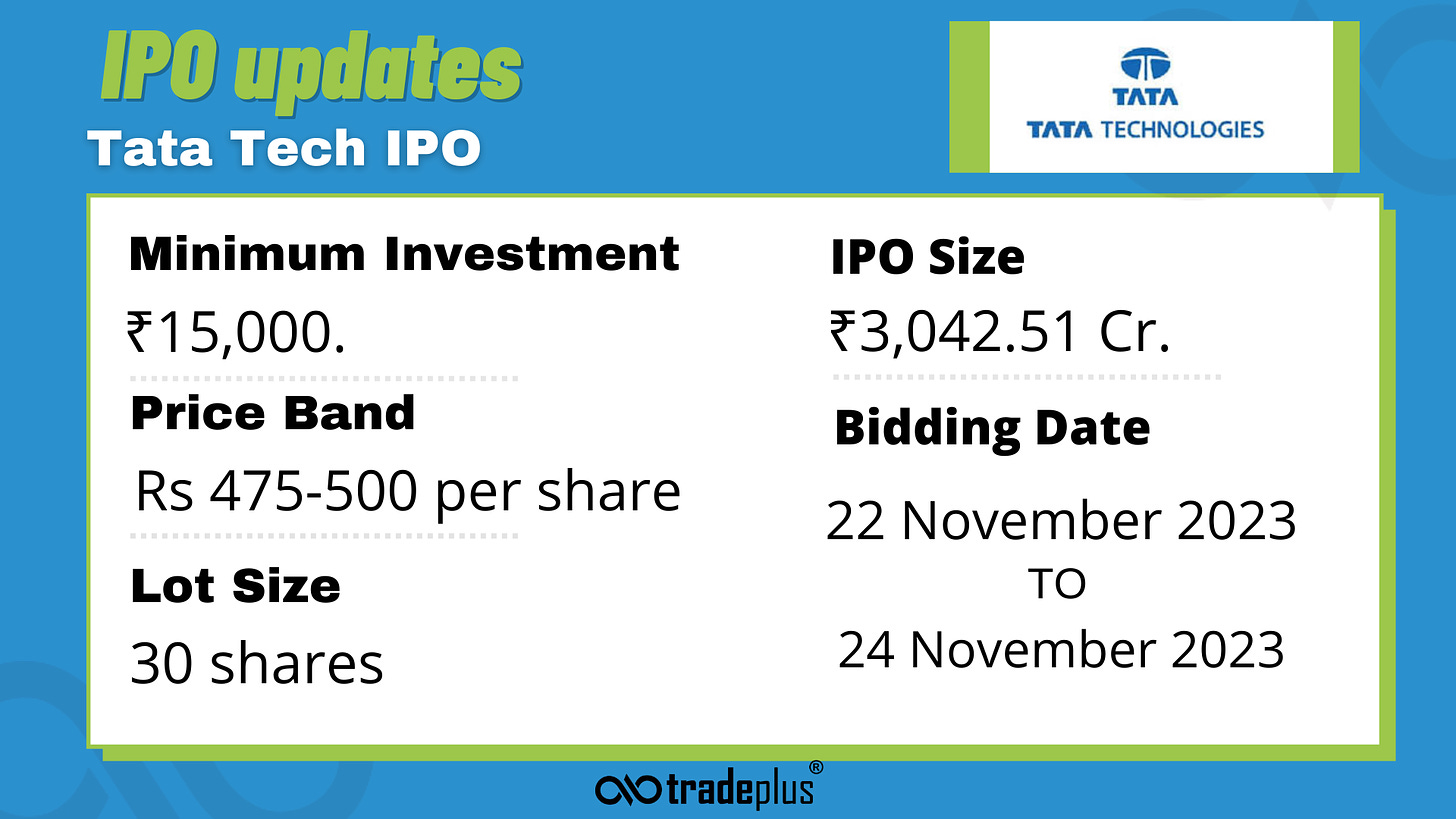

o IPO Date:22 November 2023 to 24 November 2023

o Price Band: Rs 475 to Rs 500 per share

o Face Value: Rs 2 per share

o Lot Size:30 Shares

o Total Issue Size: 60,850,278 shares (aggregating up to Rs 3,042.51 Cr)

o Offer for Sale: 60,850,278 shares of Rs 2 (aggregating up to Rs 3,042.51 Cr)

o Tata Technologies IPO Date:-

o The Tata Technologies IPO opened for subscription on 22nd November, 2023. It was set to close on 24th November, 2023

Listing Date

Tata Technologies’ shares trading started on 5 December 2023, according to the IPO schedule.

As per the company’s plan, the issue will consist of an offer-for-sale by the investors and promoters.

Promoter, Tata Motors will offload 4.62 crore equity shares, which is worth Rs 2,314 crore in the offer-for-sale.

Investors, Alpha TC Holdings Pte Ltd will be selling 97.17 lakh shares worth Rs 486 crore. Tata Capital Growth Fund I will sell 49 lakh shares, which is worth Rs 243 crore. Tata Tech has reserved 20.28 lakh shares for its employees and 60.85 lakh shares for the shareholders of Tata Motors.

Tata Technologies Share Price Band

Tata Technologies has fixed the price band for the issue at Rs 475-500 per share. Note, that at the upper price band, the company’s valuation stands at Rs 20,283 crore.

Lot Size

For the Tata Tech IPO, the investors can bid for a minimum of 30 equity shares and multiples of 300 post that. Therefore, the minimum investment by retail investors would be Rs 14,250[(30 (Lot size) x 475 (lower price band)]. Note at the upper end, the bidding amount will increase to Rs 15,000.

Now onto the million-dollar question:-

Why is Tata Tech IPO so special?

Tata Technologies IPO: The Tata Group's much-awaited initial public offering (IPO) opened for subscription on November 22, 2023. Tata Technologies IPO has gripped the pulse on D-Street, being the first issue from the group firm after nearly 20 years. Tata Consultancy Services (TCS) was the last IPO from the Tata Group which was listed on the bourses in 2004.

Ending the long wait among investors and analysts, Tata Technologies IPO set the primary market buzzing, in what market observers feel has become the most talked about IPO of this decade.

The global engineering and information technology (IT) services company has attracted the highest grey market premium (GMP) among the five mainboard IPOs to be launched this week. Tata Technologies IPO also garnered ₹791 crore from 67 investors through the anchor book on November 21.

Tata Technologies plans to raise ₹3,042.51 crore from the IPO which is entirely an offer for sale (OFS) of 6.09 crore equity shares by the promoter and investors. Tata Technologies' OFS comprises up to 60,850,278 shares including the sale of up to 46,275,000 shares by promoter Tata Motors Ltd, up to 9,716,853 shares by investor Alpha TC Holdings, and up to 4,858,425 Equity Shares by Tata Capital Growth Fund I. The Equity Shares offered through the Red Herring Prospectus are proposed to be listed on both BSE Limited and the National Stock Exchange of India Limited.

JM Financial Limited, Citigroup Global Markets India Private Limited, and BofA Securities India Limited are the Book Running Lead Managers to the Offer.

CONCLUSION

In conclusion, the Tata Tech IPO marks a significant milestone in the company's journey, reflecting its ambitions for growth and expansion. As investors eagerly participate in this offering, the success of the IPO will not only impact Tata Tech but also influence perceptions of the broader tech industry. The IPO serves as a testament to the market's confidence in Tata Tech's potential, and its performance post-listing will be closely monitored by industry stakeholders and investors alike.

We hope that you liked the 10th edition!

That’s all for this week.

See you next week with a more interesting blend.

The Editorial Team,

The Commerce Society of Ramjas College.

This week’s newsletter is designed by:

YAMINI JAIN

Insightful!

Informative!