Hello readers👋👋,

Welcome to the very 1️⃣st edition of The ComPress, the newsletter which brews a captivating concoction of finance and business world each week.

Since this is our first edition, we would like to thank you for subscribing to our newsletter :D.

For starter let us tell you what will this newsletter offer:

A meme.

A tweet/ thread related to biz world.

2 exclusive short articles written by members of The Editorial Board.

A dynamic section where each week we will share something unique.

A Thread on Blockchain…

The hottest topics to talk in finance discussions these days are bitcoin, NFT, DeFi or Web 3.

However, there are many who still don’t know what is the technology behind all these things. This twitter thread explains the concept of blockchain a simple and digestible manner.

NFTs are unique.

How PayPal Created a Mafia?

Hearing PayPal Mafia for the first time let our minds enter into a zone of gagsters and smugglers, whereas in reality, PayPal Mafia is the original business story that deserves to be told.

From social media to the auto and aerospace industries, the impact of the PayPal Mafia is amazing. Serving as a launch pad for six of its members to become billionaires, this story begins with Palm Pilots. Observing the popularity and success of PDAs (Personal Digital Assistants, with which the Palm Pilots work), Peter Thiel and Max Levchin (in 1998) decided to develop technologies to get access to person-to-person payments (with the use of PDAs) for everyone. This idea let them found a company, namely "Confinity" (Confidence & Infinity), earlier named "Fieldlink".

Another member of this mafia gang was entrepreneur Elon Musk, who wanted to create an entire online bank. In 1999, X.com was born, and the credit goes to Elon Musk and his partner. Being quick in decisions, a team was put together by Elon. Despite having grudges and disagreements with the team, he left no stone unturned in ensuring the success of X.com.

PayPal took birth as a money transfer service offered by Confinity, which was later (in 2000) acquired by X.com. This company then went on to face many challenges, but the company adapted to every challenge it faced, going from losing money to being highly profitable and overcoming issues with fraud.

In June 2001, the company changed its name to PayPal. With the hard work of team members, the company hit the jackpot in 2002 when one-fourth of transactions were handled by PayPal. This success of PayPal made Ebay (an American multinational e-commerce corporation) made an offer to acquire PayPal at a couldn’t be refused price of 1.5 billion dollars.

This deal served as a springboard moment that led to the making of six billionaires and many successful and revolutionary companies namely Space X, The Boring Company, Tesla, Linked In, YouTube , etc.

Written by- Aarushi

What the hell are Stablecoins?

Cryptocurrency is a medium of exchange just like Indian Rupees, but it is digital and uses encryption techniques to secure transactions through blockchain. Like any other fiat currency, people around the globe are trading these cryptocurrencies. But unlike the regulatory factor in fiat currency, these cryptocurrencies are not regulated by anyone. So, they are highly volatile.

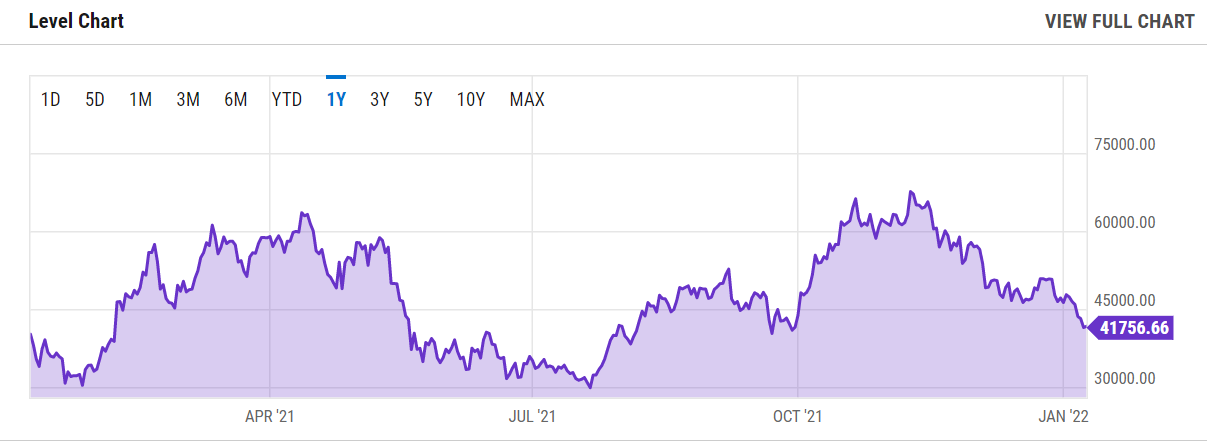

Let’s witness this from the 1-year chart of Bitcoin (BTC).

The value rose from $5000 in March 2020 to $6,500 in April 2021 before plunging by over 50% to around $30000 in June 2021. Then back to more than $65,000 in November 2021. This short-term volatility makes cryptocurrency unsuitable for everyday use.

Thus, a new breed of cryptocurrency was introduced to eliminate the price volatility and provide a steady valuation. They are called stablecoins, and they are gaining popularity in recent times. Stablecoins are an attempt to create a cryptocurrency that is not volatile. The value of a stablecoin is pegged to a real-world currency, also known as a fiat currency (like US dollars or gold). They have a lower risk as compared to the highly volatile Bitcoin or Ethereum. They attempt to bridge the gap between fiat currency and cryptocurrency.

The usage of these stablecoins is actually on cryptocurrency exchanges. A person holding bitcoin can use it to buy Tether, which lowers his risks when he thinks the price of bitcoin may fall, and vice versa when he thinks the price of bitcoin may go up. Thus, protect the interests of the trader. Because crypto coin transfers are relatively faster and cheaper than fiat currency transfers, a person can easily use them for quick settlement between the exchanges.

Stablecoins are highly criticised due to their inability to maintain the peg in the long run. Even when viewed through the lens of history, all pegged currencies are doomed to fail due to their high maintenance costs or if the crisis attacks the pegged currency itself.Some failed examples are USD to gold in 1971, CNY to USD in 2005, etc.

Stablecoins aren’t a cryptocurrency as they have a regulatory function and aren’t decentralized. Also, once the market capitalization of the cryptocurrency increases to higher levels, the volatility will decrease dramatically.

Stablecoins provide the best of both worlds – the stability of an established currency with a large market and the flexibility of a decentralized, free-for-all cryptocurrency. The problem is that they get the worst of both worlds – a centralised coin with a central bank controlling it and a questionable ability to maintain public trust in it.

The bottom line is that stablecoins are the medium of exchange that helps to reduce volatility and help with exchange without the actual involvement of fiat currency. But, in the long run, it is not certain what will happen to such coins in the dynamic crypto ecosystem.

Written by- Bhumika Bhatia

We hope that you liked this first edition.

That’s all for this week.

See you next week with a more interesting blend.

The Editorial Team,

The Commerce Society of Ramjas College.

This week's newsletter is designed by:

Yashraj Rajput

Follow us on Instagram and LinkedIn to get regular updates from the commerce society.

Highly Informative💫

Highly informative!